KEY TAKEAWAYS

- In order for Adelson to purchase a majority ownership in the Dallas Mavericks, Las Vegas Sands announced that Adelson and her family, who are the company’s largest stakeholder, would be selling $2 billion in stock.

- The NBA team’s owner, Mark Cuban, is expected to get $3.5 billion and keep some ownership in the group.

- After the Adelson transaction, Las Vegas Sands intended to repurchase $250 million worth of stock.

Following the news, the operator of the resort and casino saw a decline in share price.

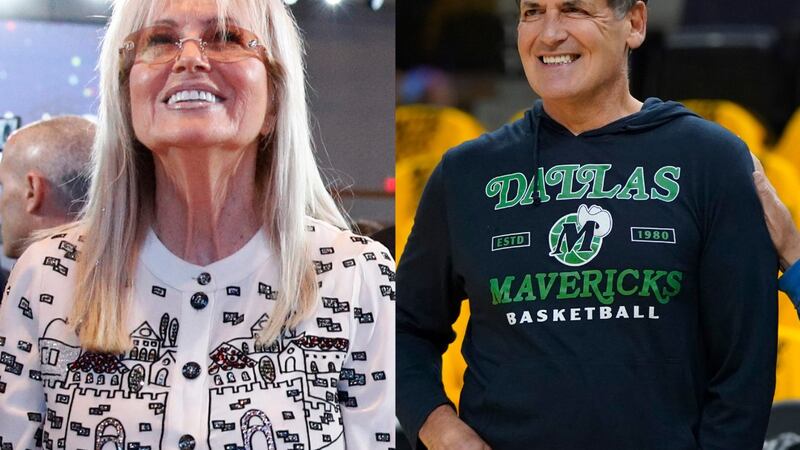

The news that Miriam Adelson and her family, the casino operator’s largest shareholder, would be selling $2 billion worth of stock so she could buy a controlling ownership in the Dallas Mavericks NBA team from billionaire Mark Cuban caused Las Vegas Sands (LVS) shares to plummet.

In a prospectus offering that was submitted to the Securities and Exchange Commission (SEC), Las Vegas Sands stated that the Adelsons would be selling 41,186,161 shares, based on an assumed public offering price of $48.56 per share—the most recent sale price recorded on the Monday, March 5 New York Stock Exchange (NYSE).About 10% of the Adelsons’ overall shareholding in the company were represented by the shares.

After receiving information from the selling stockholders, the business stated that the money was going to be used “to fund the purchase of a majority interest in a professional sports franchise.”1.According to reports, Cuban will keep ownership of the franchise and get $3.5 billion. For $285 million, he purchased the club in 2000.2.

In addition, Las Vegas Sands stated that it intended to repurchase $250 million in stock, or 5,148,270 shares, at the same offering price following the Adelson sale.1.

The shares of Las Vegas Sands are down almost 8% for 2023, not counting today’s losses.

GET MORE NEWS ON HALFTIMENEWS.CO.UK

Leave a Reply